The crypto landscape is evolving globally, not just through innovation and adoption but also with respect to how it is regulated. Increasing digital asset adoption has made it inevitable for regulators to look closely at the industry and develop meaningful frameworks for their jurisdictions. Initially, many were anti-crypto due to concerns about the asset class rocking their financial systems, acting as a vehicle for laundering, and the consequential consumer risks. Some regulators even turned to bans but were unsuccessful in addressing concerns due to the borderless and permissionless nature of the assets. Digital Asset users continued to hold and transact value over the blockchain due to the benefits, and bad actors operated in the shadows. Regulators realized the need to find better solutions by accepting the growing usage and developing frameworks to safeguard their financial systems and users. Presently, many countries are open to their citizens utilizing crypto tokens and permit crypto service providers to operate within the constraints of industry-wide regulations. International watchdogs like the Financial Action Task Force (FATF) have developed or are in the process of developing global frameworks, designed to work in conjunction with the applicable regulations in different jurisdictions. The “travel rule” implemented by FATF member nations is one such framework designed to address the concerns surrounding crypto transactions. As the regulatory shift to legitimize and control crypto usage occurs worldwide, let us look at India’s response.

India’s History with Cryptocurrency

India has had a complicated relationship with cryptocurrency usage, going from unregulated to banned to expressing interest in developing a comprehensive framework alongside other jurisdictions. Until 2018, crypto firms operated in the jurisdiction, allowing users to buy and sell the cryptocurrencies of their choice using the Indian Rupee. However, India’s central bank, the Reserve Bank of India (RBI), imposed a ban in 2018 and demanded all regulated financial institutions end their relationship with the country’s crypto service providers. It came after a long period of the regulator speaking out against crypto usage. Many crypto platforms shut down or stopped offering their services in India post-ban. That changed in 2020 when the Supreme Court of India lifted the ban, citing the RBI’s lack of justification for cryptocurrencies causing damage to the financial system or its institutions. The action revived crypto usage in the country, which had previously suffered a massive downtrend due to the ban.

How The Country’s Outlook on Cryptocurrency Usage Is Shaping Up

Today, the country is witnessing massive developments in the blockchain technology space, which the government and legislators are open to. Nevertheless, their stance toward using cryptocurrency as a financial instrument remains divided. Some legislators still propose an outright ban due to the same old worries of consumer risk, fraudulent activity, and possible instability in the financial system. Simultaneously, there are positive pointers thanks to multiple instances of virtual digital asset or VDA regulations being in the works for some time. Indian legislators were to introduce the Cryptocurrency and Regulation of Official Digital Currency Bill in 2021. However, it was postponed to another date that year and was eventually left at a standstill as legislators were keen on understanding how other jurisdictions were implementing regulations. The Indian government also introduced the cryptocurrency gains tax shortly after in 2022 – a levy of 30% on profits or gains derived from trading in crypto assets. While it was unclear whether the announcement further signaled the country’s intentions to accept crypto usage, the move was lauded by the industry which felt that it ended up providing a sense of legitimacy to digital assets. Moreover, the country’s Minister of Finance and Corporate Affairs, Nirmala Sitharaman, announced that rolling out crypto regulations is a priority of India’s 2022-23 G20 presidency. The government thus began collaborating with other jurisdictions to formulate a uniform framework to help regulators worldwide work in tandem. India’s crypto regulations will make their way very soon. Shades of the framework were witnessed earlier this year when the government directed all crypto enterprises to abide by the country’s Prevention of Money Laundering Act (PMLA) provisions. Although many crypto businesses abided by it already, the requirement acted as another step forward in implementing the much-awaited regulations. Most in the Indian crypto community expressed their satisfaction with the government moving in the right direction instead of resorting to a crypto ban yet again.

How will India’s Digital Asset Regulations shape up moving forward?

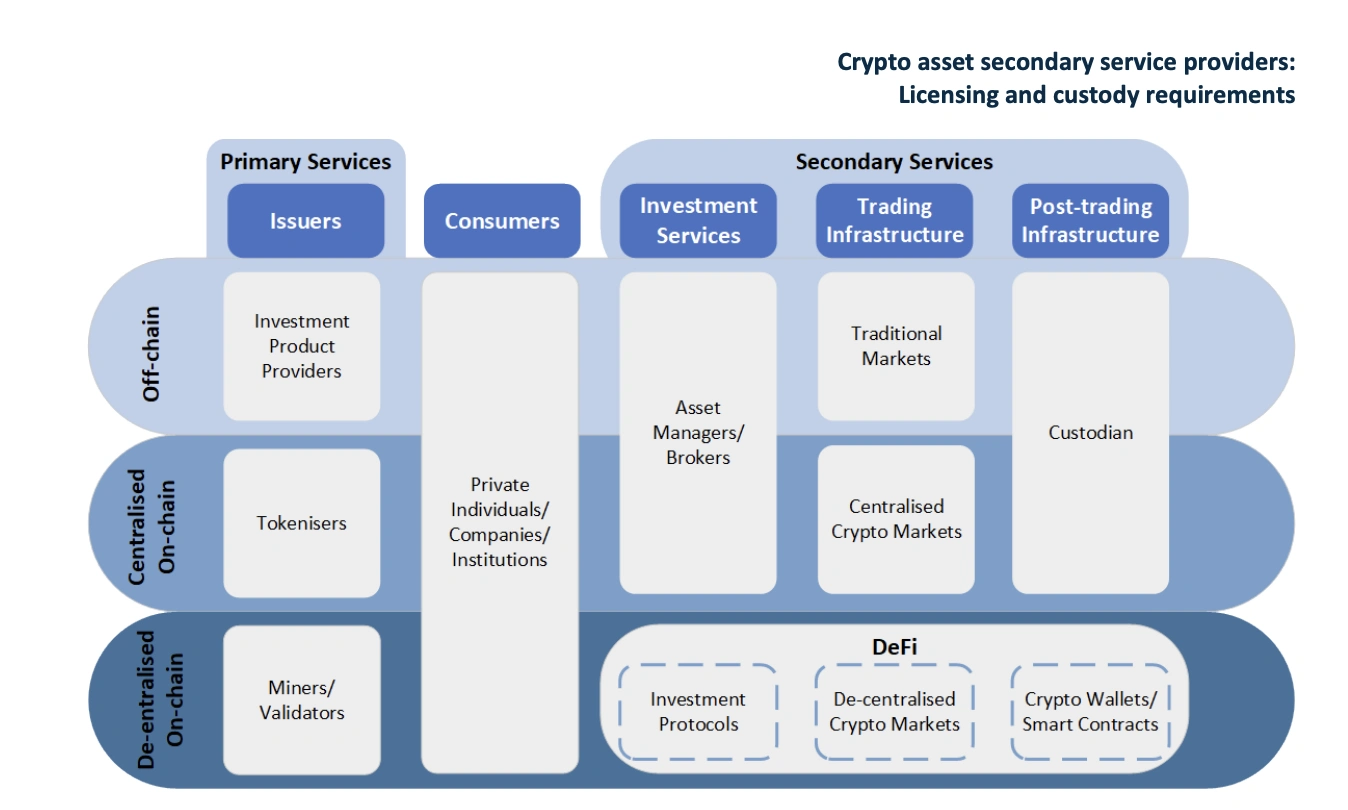

While India has already implemented several legs of a full-fledged regulatory framework i.e. Advertising Guidelines, Tax Guidelines, Reporting Guidelines, etc, it is still on the verge of implementing crypto regulations. As more regulatory clarity emerges, Indian users and enterprises will gain more confidence in utilizing and working with digital assets. As more and more frameworks keep developing it is clear that regulations will require clear bifurcation of various activities involved in digital asset transactions and each service and service provider within Web 3.0 will have a clearly defined set of rules to follow. The below image gives a sense of the various services involved in enabling digital asset transactions. To be truly effective, India’s regulatory framework will need to address each of these services spanning across off-chain, centralized on-chain and decentralized on-chain activities separately. As part of this blog series we will explore each aspect of primary and secondary services and how digital asset regulations can ensure consumer protection across all services.

With a comprehensive framework, India’s digital asset community will also experience safety as platforms will have to adhere to AML requirements and implement robust infosec measures in order to gain regulatory approval. Crypto asset storage and custody solutions like Liminal will play a critical role in ensuring the segregation of customer’s assets with the businesses’ assets and ensuring an arms-length distance between regulated trading infrastructure providers thereby safeguarding user assets. Regulations will bring about confidence in digital assets and change most Indians’ perspective towards crypto, too, reducing their fears of using the once unregulated asset class and making it favorable countrywide. Resultantly, the jurisdiction’s rapidly growing ecosystem will witness mainstream acceptance.