Cryptocurrency was written away as a concept for the fringes by financial experts and the mainstream not too long ago. Those who believed in its potential remained adamant about it rising to global prominence, and it has. Digital assets are becoming fixtures in investment portfolios everywhere, used to carry out financial transactions and park value reliably.

While the concentration of crypto usage remained mostly amongst retail investors and users, the shift towards Institutions is gaining its stride. Institutional investors are recognizing the potential, too, and exposing the asset class to their clients besides traditional investment vehicles. The growing interest is great for the industry, no doubt. However, the large amounts of institutional capital flowing into the ecosystem leaves unprecedented value at risk if not addressed duly.

Secure Crypto Custody is Vital to Facilitate Adoption

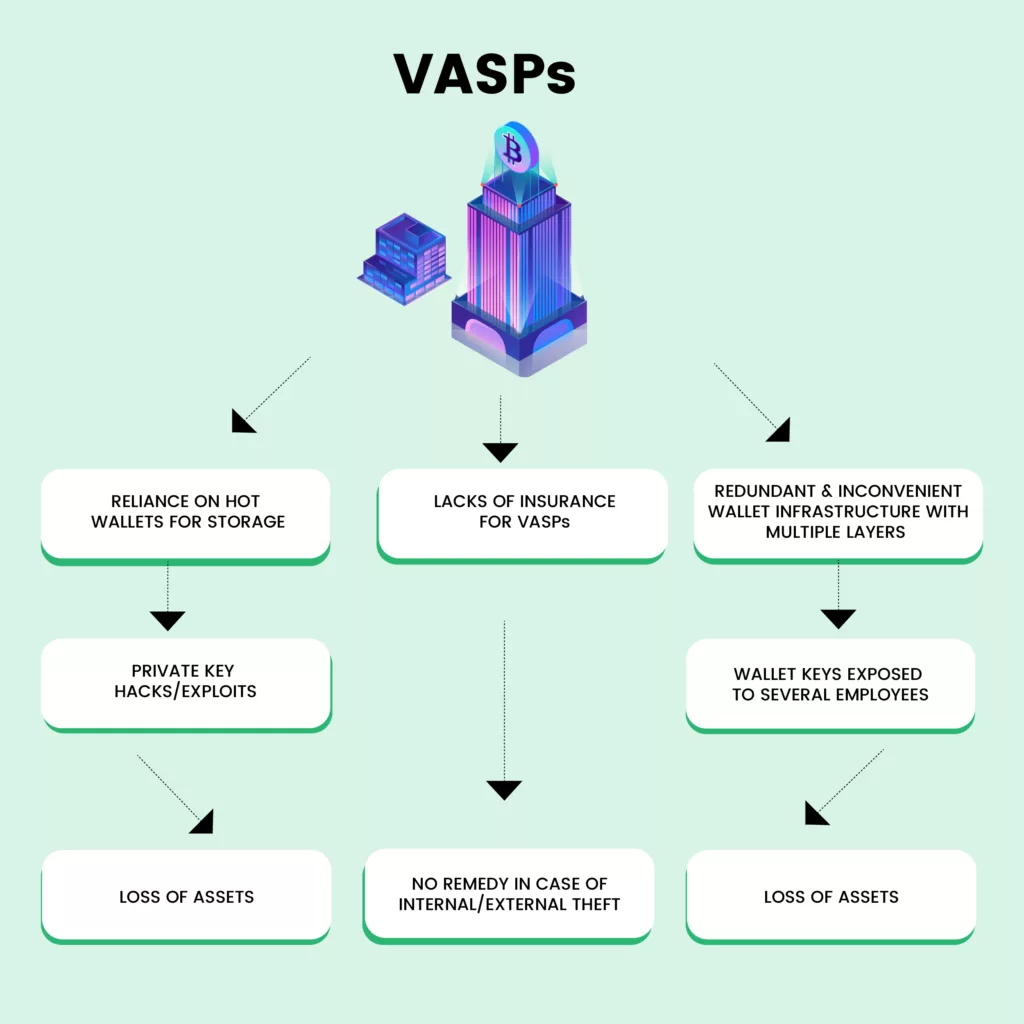

Crypto assets are vulnerable to exploits launched by cybercriminals who meticulously work to grab funds from their storages. Several users get fleeced by shady individuals and groups daily, losing their holdings to never see them again – in most cases. Holding cryptocurrencies may seem terrifying to many because of the possibility of having them stolen.

The fears get amplified by knowing about incidents where exchanges and enterprises with custodial services witness large-scale exploits too. Hundreds of millions of dollars worth of assets got siphoned out in individual attempts from some of the most trusted crypto service providers. Taking names of exploited enterprises may be redundant at this point – they are spoken about regularly.

The issues lie with security implementation by companies operating cryptocurrency-related services. Many take a lax approach when taking the non-custodial route for storing the assets brought to their platforms by their users and pay the price, sooner or later, when hackers get to their storages. Massive exchanges were leaving client assets in full within hot wallets, making themselves easy targets for theft. It comes as no surprise that many enterprises functioning carelessly go under right after being exploited.

Of course, that refers to the extreme carelessness of certain exchanges. Most do much better and implement the needed measures to safeguard the funds they custody better. Regardless, several points of failure exist within their infrastructure. Moreover, exchanges are set up with user experience in mind, making convenience their focal point. As a result, security takes the back seat.

Institutional custodians are filling the gaps left by crypto exchanges and companies in asset storage security. They operate to store large assemblages of assets as shielded as possible, making them the perfect place for institutional investors to leave their digital assets.

Such custodians operate specifically with institutional investors and enterprises, providing bespoke storage solutions. Thus, services like trading, staking, and others become secondary to custody, ensuring the greatest levels of storage safety. Some institutional custodians might not even provide any service but custody. Many exchanges and enterprises abstain from self-custody and let institutional custodians handle it because of their superior custodial services. But what about the enterprises that take the non-custodial route?

Regulatory Frameworks Are Driving Enterprises to Put Asset Safety First

As institutional custodians remain a viable option for institutional investors making their entries to the crypto ecosystem, sub-par alternatives operating are still a problem. Offering custody service without adhering to the highest standards brings undue risks to the ecosystem. Investors must possess the safest options to trust their crypto assets despite being retail or institutional. Financial regulators worldwide understand this and are pushing out regulations to ensure exchanges and other crypto enterprises operate with the same standards of institutional custodians when they store user assets.

For instance, Hong Kong recently released its regulatory mandates for service providers to operate legally in the jurisdiction. This framework is now considered one of the most extensive and detailed, protecting users to the largest extent and leaving no requirement unclear to crypto-native businesses. Exchanges natively storing user assets should develop highly robust asset storage and transport systems, leaving no vulnerabilities unaddressed.

Even a jurisdiction like the Abu Dhabi Global Market (ADGM), considered friendly to crypto businesses, has stringent regulations for how enterprises custody investor assets. Innovation in the crypto industry is heavily reliant on how secure it is.

ADGM was an early acceptor of crypto usage, legalizing it in 2018 with a comprehensive regulatory structure for enterprises to follow. Since then, it has pushed them to focus on safeguarding the user value they handle. Its regulatory approach gets utilized as a model by other jurisdictions designing their frameworks. Setting up shop here as a crypto service provider requires enterprises to meet high-level asset storage security measures, just like in Hong Kong.

Liminal’s Storage Solutions Can Help Enterprises Meet Rigorous Regulatory Demands

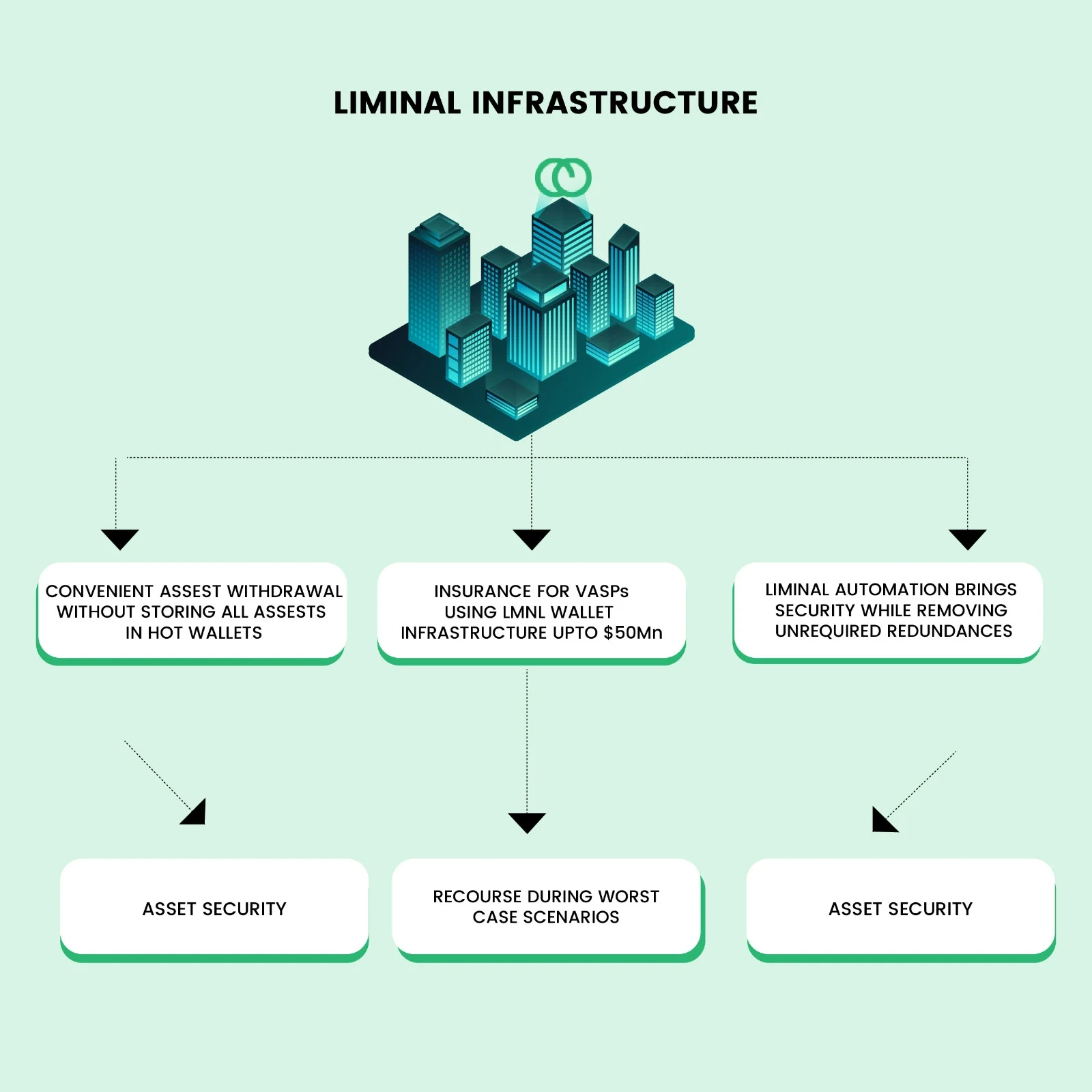

Liminal brings institution-grade self-custody measures that address regulatory security requirements while providing the efficiency that enterprises look for. Its asset storage systems comprise enterprise cold and hot wallets, with minimal funds moving from the safer cold wallets to the vulnerable hot wallets to maintain sufficient liquidity.

Enterprises can securely store user assets in cold wallets, away from hackers, with the Liminal proprietary smart wallet enabling timely automatic refills to hot wallets for undisturbed, convenient user withdrawals. Gone are the days of enterprises risking storing all the assets they manage on hot wallets for convenience. Furthermore, asset transfers between the varying wallet elements in the infrastructure are safeguarded by the Liminal Policy Shield, initiating transactions only after successful wallet authentication.

Liminal also adheres to timely audits of all aspects of its infrastructure storage solution, keeping emerging vulnerabilities at bay and enterprises safe from the evolving threats posed by cybercriminals. Worst-case scenarios are always possible, and no crypto-related business can be too secure from vulnerabilities. They may rest easy, regardless, thanks to Liminal’s insurance coverage protecting the assets stored with its solution up to $50 million.

The initiatives taken by Liminal in assisting enterprises to secure their clients’ funds are up to the expectations of the regulations set forth by Hong Kong and the ADGM. Moreover, the solution will help enterprises comply with the EU’s MiCA (Markets in Crypto Assets) legislation and those of other jurisdictions emphasizing enterprise custodial security.

As Liminal’s custody infrastructure matches the requirements of financial regulators worldwide, it is safe to assume the solution will satisfy those of the jurisdictions on their way to legalizing crypto usage.

The infrastructure provider foresees the need to safeguard assets in enterprise custody and leaves no page unturned in addressing the vulnerabilities faced by enterprises. With that, exchanges and enterprises can confidently custody assets for institutional investors while focusing on other services like trading, staking, and more.Feel free to learn more on how Liminal’s custody infrastructure can help you here.