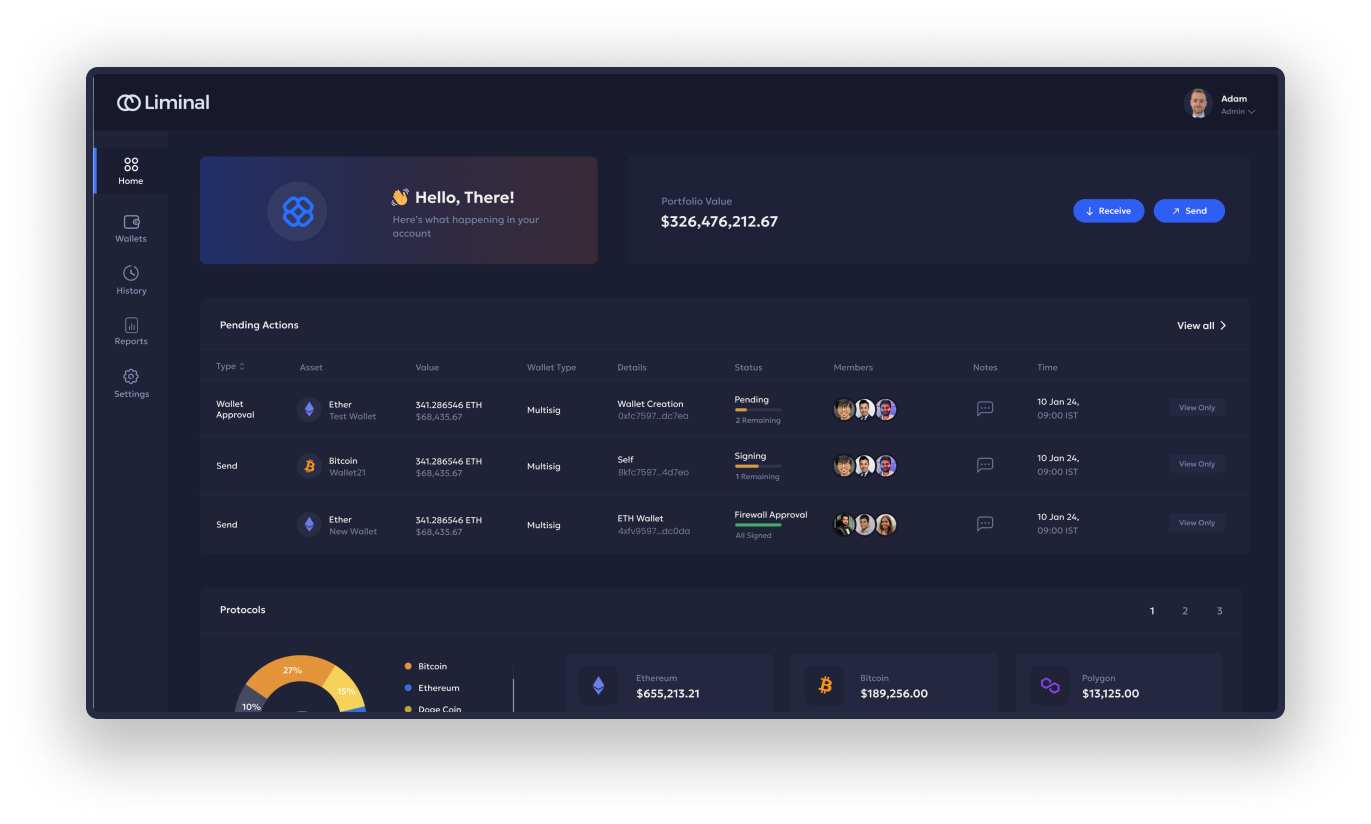

Restrict fund transfers to pre-approved addresses, strengthening security and compliance

Set limits on single transactions and overall spending within a timeframe, providing additional risk management tools

@2024 First Answer Pte.Ltd. All rights reserved

Created with by Liminal

Liminal has not yet launched its regulated custody platform in the United Arab Emirates (UAE). The commencement of regulated custody operations in the UAE is contingent upon receiving a full license from the regulatory authorities in the Abu Dhabi Global Market (ADGM) and the Virtual Asset Regulatory Authority (VARA). Crypto products and NFTs are unregulated and can be highly risky. There may be no regulatory recourse for any loss from such transactions. Liminal does not provide legal, tax or financial advice. Liminal is not responsible for loss of funds, data, or business disruptions arising out of user negligence or normal course of business. Users must secure their assets and acknowledge inherent risks, such as technical issues, evolving regulations, third-party hacks and market volatility. Digital assets are not legal tender and the transactions may be irreversible. Users should carefully assess these risks before using the platform.

@2024 First Answer Pte.Ltd. All rights reserved

Created with by Liminal

Liminal does not provide legal, tax or financial advice. Liminal is not responsible for loss of funds, data, or business disruptions arising out of user negligence or normal course of business. Users must secure their assets and acknowledge inherent risks, such as technical issues, evolving regulations, third-party hacks and market volatility. Digital assets are not legal tender and the transactions may be irreversible. Users should carefully assess these risks before using the platform.

It is long established fact that a reader will be distracted by the readable content of a page when looking at its layout. The point of using Lorem Ipsum is that it has a more-or-less normal distribution of letters. as opposed to using ‘Content here’. ‘content here’. making it look like readable English . Many desktop publishing packages and web pages editors now use Lorem Ipsum as their default modal text, and a search for ‘lorem ipsum’ will uncover many web sited still in their infancy. Various version have evolved over the years, sometimes by accident , sometimes on purpose{injected humor and the like}

It is long established fact that a reader will be distracted by the readable content of a page when looking at its layout. The point of using Lorem Ipsum is that it has a more-or-less normal distribution of letters. as opposed to using ‘Content here’. ‘content here’. making it look like readable English . Many desktop publishing packages and web pages editors now use Lorem Ipsum as their default modal text, and a search for ‘lorem ipsum’ will uncover many web sited still in their infancy. Various version have evolved over the years, sometimes by accident , sometimes on purpose{injected humor and the like}